November 2025

If you’re considering buying commercial property, whether it’s an office, retail unit, warehouse, or industrial space, you might be wondering about the costs involved, particularly stamp duty. Here at Hellier Langston, we understand that navigating the complexities of commercial property transactions can be daunting.

One of the key financial considerations is Stamp Duty Land Tax (SDLT), a tax that applies to the purchase of any property in England and Northern Ireland. In this article, we’ll clarify when you pay stamp duty on commercial property, how it’s calculated, and what that means for you as a buyer or investor.

Stamp Duty Land Tax is a government tax paid on property purchases above certain price thresholds. While many people are familiar with stamp duty on residential homes, commercial property stamp duty follows its own set of rules which can significantly impact your overall budget for commercial property investment or acquisition.

When you buy commercial property, stamp duty generally applies to the purchase price or market value of the property (whichever is higher). This includes standalone commercial properties as well as properties with mixed uses, such as a building with shops on the ground floor and flats above.

If you are buying commercial property for sale, you are required to pay Stamp Duty Land Tax if the purchase price exceeds £150,000. For mixed-use properties, different rates may apply, which combine elements of residential and non-residential tax bands. If the property price falls below this threshold, no stamp duty is due.

For example, if you purchase a retail premises for £200,000, you will have to pay SDLT on the amount above £150,000 based on the applicable commercial rates. Conversely, if you buy an industrial unit priced at £140,000, no stamp duty is payable.

This threshold is crucial for business buyers and commercial property investors looking to gauge the immediate costs of acquisition.

The rate at which you pay SDLT depends on the property price. For commercial properties, the structure is tiered, with several bands:

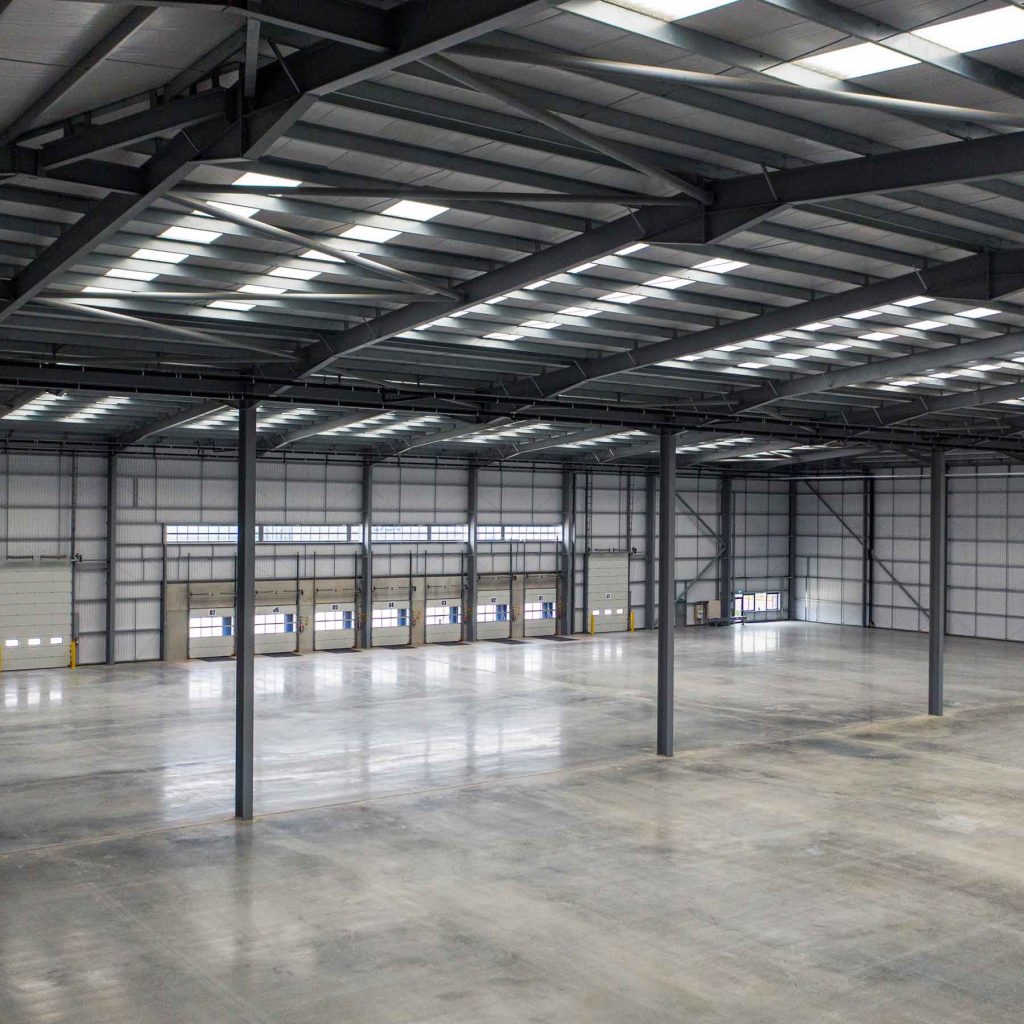

To illustrate, if you buy a commercial warehouse valued at £400,000, your stamp duty would be calculated as follows: zero on the first £150,000, 2% on the next £100,000 (£2,000), and 5% on the remaining £150,000 (£7,500), amounting to £9,500 in total SDLT.

For mixed-use properties (where part of the property is residential and part is commercial), a different SDLT rate scale applies, which can be more complex to calculate. Engaging a specialist commercial property solicitor or commercial property agency like Hellier Langston can help you ensure you pay the correct amount and avoid any costly miscalculations.

When purchasing commercial property, it’s worth considering other costs such as legal fees, due diligence, surveys, and insurance. For example, commercial property insurance is essential to protect your investment against risks like fire, flood, or theft. At Hellier Langston, we work closely with specialists across these areas to offer you a seamless, forward-thinking service. Get in touch with our friendly team of experts to find out more today.

Acquiring commercial property can be a significant investment, and the financial landscape around it can be complex. Whether you’re seeking commercial property for sale or commercial property for rent, our experienced team at Hellier Langston will guide you through every step, including advice on stamp duty and other transactional costs.

As a trusted commercial property agency, we help you identify suitable opportunities, understand market values, and navigate legal and financial processes with confidence. We can also put you in touch with expert commercial property solicitors to ensure your purchase complies fully with regulations, including SDLT payment.

If you’re considering your next commercial property investment and want to understand your total financial commitment, including stamp duty on commercial property, get in touch with us at Hellier Langston today. Our team is here to provide clear, expert advice tailored to your specific needs.

Are you ready to explore the commercial property market with confidence? Navigating stamp duty on commercial property doesn’t have to be complicated. With the right advice and support, you can make informed decisions that protect your investment and maximise your returns.

Whether you’re hunting for your first property, looking to expand your portfolio, or seeking commercial property for rent, Hellier Langston has the expertise to support your ambitions. Contact us to get a quote or learn more about how stamp duty and other costs might affect your purchase. You can also visit our website to browse current listings and discover how we can make your commercial property investment straightforward and successful.

Discuss how we can support you with expert guidance on your lease situation.

Contact us